Why quantum computing’s inflection point is a far bigger deal than most assume, using Bitcoin as a case study.

For the past several months I’ve found myself thinking about “Q-Day”—the hypothetical moment when a large-scale, fault-tolerant quantum computer can break today’s public-key cryptography in practical timeframes. The term gets thrown around casually, but the underlying assumptions are almost always shallow. Industry conversations typically hover at the level of “someday RSA and ECC will be broken, we’ll swap in post-quantum crypto.” But if you model the actual math and network effects, the impact is far more systemic than most realize.

The Cryptographic Assumption Underneath Bitcoin

Bitcoin’s security rests on two primitives:

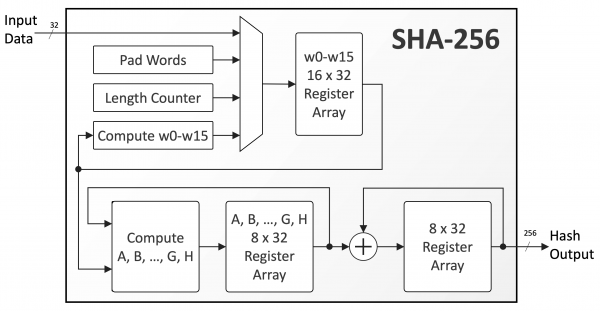

- SHA-256 for proof-of-work hashing,

- secp256k1 ECDSA for digital signatures and address control.

Most casual observers treat SHA-256 and ECDSA as equally “quantum resistant,” but they’re not. Grover’s algorithm only gives a quadratic speed-up for symmetric hashes (meaning SHA-256’s effective strength drops from 256 bits to ~128 bits—still enormous). Shor’s algorithm, on the other hand, annihilates ECDSA once a quantum machine has enough logical qubits and error-correction throughput. The moment Shor’s algorithm crosses that threshold, every unspent output on the blockchain tied to a public key rather than a hashed address becomes trivially spendable. That’s not a niche corner case—it’s a significant slice of historical Bitcoin, and the attack model is radically different from anything in classical cryptanalysis.

“Q-Harvesting” and Retrospective Attacks

Even more underappreciated is harvest-now, decrypt-later economics. On a permissionless network like Bitcoin, every signature and public key is permanently recorded. A future attacker with quantum capabilities can retroactively sweep old UTXOs or forge transactions if private keys are exposed. Unlike TLS or ephemeral session keys, Bitcoin signatures don’t vanish after a handshake—they’re immutable history. This is precisely the kind of environment where Q-Day isn’t just a forward risk; it’s a retroactive event horizon.

Migration Isn’t a Patch Tuesday

Post-quantum migration in a blockchain isn’t like rotating TLS certificates. To transition Bitcoin to a quantum-safe signature scheme (Dilithium, Falcon, SPHINCS+, etc.), you need to:

- Introduce and standardize new script opcodes,

- Achieve miner consensus on soft/hard forks,

- Incentivize holders to proactively move coins to new address types,

- Handle the “long tail” of lost keys or inactive wallets.

Any laggards become low-hanging fruit the moment a capable quantum adversary exists. The coordination problem dwarfs the mere cryptographic problem.

Why “Q-Day” Is a Deal No One’s Pricing In

The typical narrative assumes Q-Day is some distant, binary switch—“crypto breaks overnight.” In reality, we’ll likely see a gray zone where early quantum machines can break small-bit ECC but not 2048-bit RSA, then gradually scale. The first usable machine doesn’t need to break all of ECDSA at once; it just needs to cherry-pick vulnerable addresses or chain states to create cascading trust failures. That asymmetric phase could destabilize systems long before a headline “RSA broken” moment.

The upshot is that the cost-benefit math of preparing early versus reacting late is inverted for public, immutable systems. For Bitcoin (and any long-lived ledger), the ROI on proactive migration is enormous, because the tail risk isn’t “some downtime,” it’s mass asset exfiltration at quantum speed.

What Can Actually Be Done Now

Technically, we’re not helpless:

- Quantum-safe address formats can be introduced today and incentivized with lower fees or higher priority.

- Hybrid signatures (ECDSA + PQC) could offer defense-in-depth during migration.

- Wallet UX could default to never revealing public keys until absolutely required (minimizing harvestable data).

- Research funding into quantum-safe primitives optimized for constrained environments (hardware wallets, embedded nodes) is critical, not academic.

The bigger challenge is social, not mathematical: coordinating a global network with trillions of dollars at stake before the adversary is visible.

I keep circling back to the same conclusion: “Q-Day” isn’t a far-off curiosity—it’s a pricing error in the security model of every immutable public ledger. Bitcoin is the clearest illustration because of its permanence and economic weight, but the same logic applies to PKI, code-signing, IoT firmware updates, and even archived TLS traffic. The longer we treat quantum risk as tomorrow’s problem, the more we guarantee it becomes a retroactive catastrophe instead of a forward-looking migration.

If you’re in a position to influence protocol roadmaps or asset custody, the optimal time to act was yesterday. The second-best time is now.